The Pros and Cons of Using a Personal Loan for Debt Consolidation

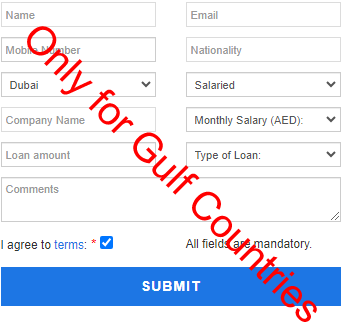

In our daily lives, many of us avail of different loans that meet our financial requirements. It is not a bad idea but when the repayments per month are higher, it will enhance more burden of finances on borrowers. If you are also facing this scenario of paying higher payments of credit card, auto debt, mortgage, etc., you have an option of consolidating all of these debts into one debt. Personal loans are the first and easier preference for the consolidation of all existing debts. But you should be aware of The Pros and Cons of Using a Personal Loan for Debt Consolidation. Then, you will be able to make a good decision if the consolidating process is helpful for your finances or not. Every lender offers personal loans with specific terms, you have to read all the terms and make sure it is without higher rates. If you avail of a personal loan through Loansforgulf, you will easily repay the fund in monthly lower installments.

Debt consolidation

Debt consolidation is an effective way of instantly paying down numerous loans at a time through the availing of another loan. When you use a personal loan for the consolidating process, every existing loan will easily pay off. Many lenders suggest you choose personal loans if you want for debt consolidation. Thus, with this quick method, your multiple payments of different debts will convert into on monthly payment.

Pros of Personal Loans for Debt Consolidation

There are numerous advantages of debt consolidation that you should know if you are under the stressful situation of paying debts’ higher repayments. The major pros are:

Lower interest rates:

As compared to other types of loans including credit cards, the personal loan’s interest rate is lower. You will easily get this fund with low rates especially when your credit score is good. The collective rate of all existing debts is higher than this single loan’s rate. In general, the terms, tenure, and rates all depend on the credit scores.

Faster debt repayment:

The only way to pay off the loan repayments is when you use a personal loan for debt consolidation. When you pay high credit card debts, it will negatively impact your financial life. Paying down the balance of a credit card is without the timeline of payments. So, when you consolidate the debts, you will get to know the exact timeline of monthly repayments and then conveniently pay off the fund.

Fixed repayments:

The main advantage of personal loans is that they come with fixed monthly repayments. Each month, you will pay off the same amount of the installment. Even, you will know the term of the ending month of repayments. In particular, the fixed repayments are not higher if the lender provides you with this debt at lower rates.

Simplified finances:

It is a hectic task to remember the due dates of debt repayments every month. But when you will repay only one repayment each month, you will have simplified finances. In addition, the amount of the monthly installment is also the same, so you know how much you have to pay. And, as a result, you will need to remember only paying one installment monthly.

Boost credit:

There is a chance of decreasing your credit score when you use a loan for debt consolidation. However, it is not a major problem because you can easily improve your score by constantly paying off monthly payments. Generally, your score will easily enhance and then it will make good credit history as well.

Cons of Personal Loans for Debt Consolidation

Before choosing a personal loan for the consolidation, you need to consider all the following mentioned cons:

Up-front costs:

There are numerous fees that come with the personal loans including annual, origination, closing, fees, etc. Before choosing a debt consolidation, make sure the up-front costs are lower. Due to paying off these fees, the loan amount becomes costly for you. However, Loansforgulf is a financial company that will not charge any processing fee when you obtain a loan through this company.

May pay high rate:

Although the rates are not higher, but when you pay lower monthly installments for a longer period, you will pay more interest. And then, the overall rate of the loan becomes higher in contrast to shorter-term debts.

Late payment fee:

The result of missing or late payments will lead to paying fees for late payments. And, more continuously missing payments cause the loan default. It will reduce credit scores and the borrower have to pay extra penalty charges. And, its major consequence is that qualifying for another loan in the future becomes a tough task.

Risk of losing your asset:

If you apply for a secured personal debt, there is a requirement for collateral. It helps in getting of lower interest rate on debt but when you fail to repay the amount, you may lose your asset.

The bottom line:

The consolidation of debts is only an impressive idea if you get this loan with lower rates and favorable terms. So, you will easily consolidate all other debts with the getting of the new debt amount. The new debt is majorly dependent on the credit score & history. Even, many lenders consider other financial factors such as steady income sources. Lastly, you will quickly pay down the debts and then easily make your financial budget according to the repayments amount.