The Impact of Loan Defaults on Credit Score

Loans are one of the most powerful tools to achieve your dreams. In the UAE, financial institutions offer loans at reasonable rates. With financial help, you can efficiently meet your needs. Moreover, one of its benefits is that it builds the credit score. A higher score is an ideal thing to avail of loans with lower rates and longer tenure periods.

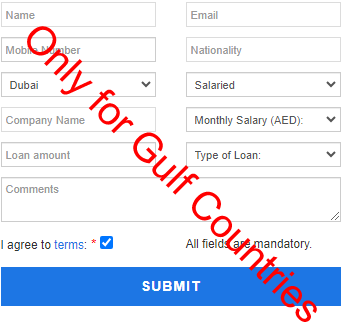

But, defaulting on loans has also negative impacts on credit scores. You must give your attention in order to pay of payments. So, you will save from the situation of loan default. In this blog, we are explaining the Impact of Loan Defaults on Credit Score. As a result, when you take a loan, you will be serious in the repaying of the debt amount. So, you will never be involved in the issue of defaulting. Choose a lender that offers loans with favorable terms. That’s why the financial company Loansforgulf considers the applicant’s financial situation. So, they provide the finances with a longer tenor. They make sure their clients do not go through the scenario of loan default. Thus, the borrower’s score will remain excellent.

What is a loan default?

In most cases, the loan default happens due to the missing or delaying of payments for a specific time duration. After the loan defaults, the lenders contact agencies of debt collection that collect the debt amount from the borrowers.

Mostly, the loan providers are always willing to help their clients. In case, you are facing difficulty in managing or paying off payments regularly, negotiate with your lender. The lender gives you the option of lowering the monthly payments or debt consolidation. Both of these options will never lead to debt default.

How does loan default impact credit score?

The credit history is an essential factor that lenders will check when giving approval on an applicant’s application of debt request. This history is made with the person’s score. A good score is great for getting a loan with lower rates. It is the most essential point that repayment must be on time without any late. Otherwise, loan default has a negative effect on the credit score and history. The later payments are the biggest reason for the impact on scores. To keep a good credit score, you must be careful in the paying of the payments. Avoid missing or late repayments.

The relaxing point is that if the payment is late for less than one month, you will get a chance to clear the dues quickly. Mostly, lenders offer a grace period of thirty days before adding the penalty of late installments. You will need to communicate with your lender if you are not able to repay the installment within 30 days. Loansforgulf’s professionals suggest making your budget finances wisely. Thus, there is no problem of repaying the installments.

30 days late payment

The first thing that a lender does in case of a 30-day late payment is to send your report of missed payments to a credit bureau. And, the credit bureau will take action to reduce the credit score. In general, the score will reduce 100 points of the missed payments in the first 30 days. For all those borrowers with higher scores, the reduction of the points is also higher. The late repayments impact the credit reports for at least a few years.

30-90 days late payments

The period of 30-90 days late payments shows that the borrower missed two or three installments per month. The loan providers do not compromise on the missed repayments. They take the action of sending reports to bureaus. The credit scores will decrease by 100-200 points depending on the number of missed payments

180 days late payments

The duration of 180 days late payments is the five months of the tenure of the loan. In this case, the creditor gives authority to a third party for the collection of the debts. Now, the creditor will not deal with the borrowers for their repayments. As a result, the credit history will become too bad due to a decrease in credit scores.

Avoiding loan defaults

It is crucial to avoid loan defaults if you want to maintain your credit score. Never compromise on the reduction of your scores. It is only possible when you repay the amount of debt on time in the form of monthly installments. Avoid taking higher loans which come with higher rates and not longer tenure. In this way, the good option is to not avail loan from a credit card. It is because of the fact that credit card loans are with higher costs.

The managing of existing debts is also crucial. Always make on-time repayments. To do it, you should reduce your other finances. The payment must be regular, so you should choose the option of lowering the monthly installment. Another factor for saving yourself from loan default is to check your credit report continuously. The bureaus also provide free reports. Therefore, you will know if there is a risk of any chance of reducing the scores. Sometimes, you will also get a warning of a bad score in case of missed payments.