Non-salary Transfer Personal Loan in UAE

In any emergency financial situation, you will instantly need the finances to solve the issue. Quickly availing of extra finances is possible through the application of personal loan in UAE. In this country, the lenders also offer personal loans with no requirement of salary transfer. That’s the reason it becomes an ideal option for every borrower. All salaried applicants have an option of easily availing of the debt without transferring their salaries. Every bank and online lender considers the client’s financial needs and then provides them with loans accordingly. Loans for Gulf gives you a loan amount according to your monthly salary but this lender does not require the transferring of your salary. Overall, the paperwork is also not tricky and you will easily apply without any difficulty.

Personal Loan with non-salary transfer

A personal loan is a suitable debt type that can be used for any purpose. For instance, if you need to pay bills, educational fees, house rent, etc., this debt is an appropriate option. Moreover, many individuals in the UAE apply for it when they require urgent finances for unexpected medical expenses. It is the most convenient way that you can quickly apply and receive the funds. This loan comes with both choices of salary transfer and not transfer. For a non-salary transfer loan, there is no need to transfer of salary to the lender’s bank and you will receive the debt amount instantly after the approval.

Specifications of non-salary transfer personal loans

There are a lot of specifications of this loan type that you should know when you want to apply and get this debt. All of its specifications show that it is an effective step towards managing your financial issues. Look at the following specifications & advantages of it:

-

Sometimes it is difficult to obtain higher debts from the banks or other lenders. But, this type of debt comes with the option of getting higher debt amounts. The maximum loan amount is more than 150000 AED. But the lender will check your financial profile also.

-

The loans’ interest rates are very competitive and therefore it becomes a less costly loan when you repay the amount in every month’s installment.

-

Refunding of debt is very convenient because of the longer tenure. The repayment duration is at least 48 months. For higher debts, the duration is much longer than low debts.

-

Like no need for salary transfer, there is also no necessity for collateral when you apply.

-

The complete paperwork is not complicated and as a result, the processing is done speedily. In general, Loans for gulf financial company also assists you if you encounter any difficulty during the application process.

-

Numerous banks also give extra points with this loan on your credit. Those points help you in getting discounts on shopping.

-

In addition, you can also choose the Islamic finance option if banks provide it. This finance option works on the basis of Islamic laws.

Eligibility factors to get qualification:

There are various factors that should be considered if you want to get qualification for the obtaining of the loan amount. These factors are the eligibility criteria:

-

First of all, the lender will check your monthly income. To quickly get approval, the income must be more than 12000 AED per month.

-

Secondly, your current job duration should be at least six months in a company. Employment is the most crucial factor because without meeting it, the applicants will never get approval for a loan application.

-

Besides, you have to carefully choose the amount of monthly installment. Every month, you will pay the same amount to the lender. And, the important thing is that the ratio of monthly installments should not be higher than 50% of monthly income. It shows that you will never face difficulty in paying off the debt and then there will be no chance of a loan default. The higher monthly income of applicants receives the approval more quickly.

Important documents to attach

After meeting the eligibility factors, you will need to check the list of all important relevant documents. These documents will be attached to your application form. In case of any invalid document, the loan application will be rejected by the lender. The documents are:

-

Copies of both passport & visa

-

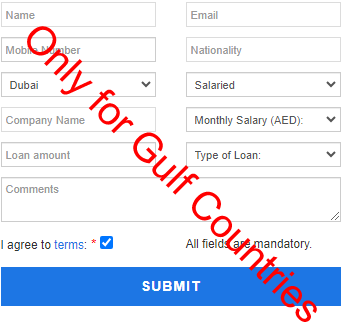

Complete the application form

-

One copy of your Emirates ID

-

One security cheque (if lender demands)

-

Show the certificate of your monthly salary

-

Direct debit form

-

Latest bank statements for three months

How can you use a personal loan in UAE?

Without any restriction, you can use this loan in UAE without a salary transfer. The repayments of numerous loans at a time are costly for a borrower. So, the best decision is to take a new personal loan for the consolidation of debts. Then, you will be required to pay only one installment in a month and its amount is lower than the other debts’ installments. Furthermore, for planning any of your vocational trips, you will require extra finances to meet the trip’s expenses. And, when you are in a stressful situation of how to manage the expenses of your big wedding day, you should apply for this debt. Many lenders offer home or car loans but their interest rates are higher. However, the finances of a personal loan can be used for buying a new vehicle or renovating your home. And, the repayments are with lower interest. Thus, the repaying of funds becomes not costly for you. You can easily pay the installments in each month.